Cryptocurrency Taxation in India

A Comprehensive Legal & Compliance Guide 💰📜

Why Crypto Taxation Matters in India 🧐💡

Cryptocurrency in India has evolved from a niche interest to a booming financial asset class. 🚀 Whether you’re a casual investor, an active trader, or a DeFi enthusiast, understanding the tax implications is crucial. India’s tax authorities have taken a strict approach, and non-compliance can be costly.

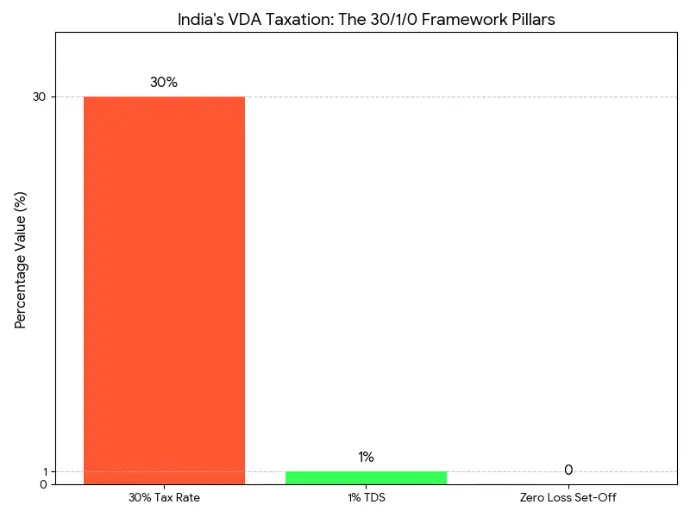

In 2022, the Finance Act introduced explicit rules for Virtual Digital Assets (VDAs), including cryptocurrencies, NFTs, and other digital tokens. These rules often summarized as the “30/1/0 Framework” make India’s crypto taxation some of the most stringent globally. This blog is designed to give you a complete, experience-driven guide, covering legal definitions, taxation mechanisms, compliance requirements, and strategies to stay fully compliant.

By the end of this guide, you’ll have a clear roadmap to navigate crypto taxation, avoid penalties, and make informed financial decisions in the Indian context. 💡📊