Structure of India’s Tier-2 & Tier-3 Investment Revolution

A Roadmap to Financial Empowerment 💹🇮🇳

The Indian financial landscape is undergoing an extraordinary transformation. Once dominated by the Top 30 metropolitan hubs, capital markets are now witnessing an unprecedented democratization, driven by the influx of retail investors from Tier-2, Tier-3, and B30 cities. 🌆💸 These emerging centers are no longer peripheral participants; they are shaping the very architecture of India’s capital market, fundamentally redefining liquidity, market depth, and domestic stability. The structural shift is being fueled by digital accessibility, formalization of regional wealth, and a generational shift toward financial literacy and ambition.

The growth of the Beyond Top 30 (B30) segment is not just a statistical anomaly; it reflects a profound societal change. Young investors, with a median age of 32, are entering the financial ecosystem with disposable incomes below ₹5 lakh, yet with an outsized appetite for equity investments. 📈 Their risk-seeking behavior is evident, with 86% of assets allocated to equity schemes and a significant portion engaged in speculative Futures and Options (F&O) trading. This dynamic presents both opportunity and challenge: while the market benefits from heightened retail participation, systemic risks emerge if speculation outpaces disciplined investment.

To navigate this nuanced ecosystem, a carefully calibrated strategy involving regulators, financial institutions, and FinTech platforms is essential. Localization of financial products, rigorous enforcement against unregistered digital advisors (Finfluencers), and vernacular financial literacy campaigns are indispensable tools for sustaining growth while safeguarding investors. The roadmap, if executed with precision, promises to convert high-volume participation into disciplined, long-term asset accumulation. 📊

Defining the Geography of India’s New Investor Wave 🌏

Understanding the classification of non-metro markets is vital for appreciating the scale of India’s financial transformation. The Securities and Exchange Board of India (SEBI) and Invest India classify cities into Tier-2 and Tier-3 segments based on population criteria. Tier-2 cities, with populations between one and five million, function as emerging financial hubs. Examples include Visakhapatnam, Kochi, and Raipur. Tier-3 cities, with populations from 0.1 to one million, such as Nagpur, Indore, Patna, and Bhopal, drive regional development and foster employment through MSMEs.

Simultaneously, the Association of Mutual Funds in India (AMFI) framework identifies the Top 30 (T30) locations as traditional metros and primary financial centers. Beyond these, the B30 segment represents a vast, underpenetrated market that is demonstrating aggressive investment behavior. This includes both high account volumes and a youthful, risk-tolerant demographic. The significance of B30 markets extends beyond mere numbers; it signals a structural reorientation of capital formation in India.

By January 2024, the total Demat accounts in India reached a staggering 14.39 crore, with CDSL commanding nearly 75% of these accounts. 📈 This disproportionate volume versus value underscores that the initial wave of B30 investors is characterized by small-ticket accounts, laying the foundation for future disciplined investment as financial literacy improves. Conversely, NSDL maintains dominance in asset value, reflecting its concentration among high-net-worth individuals and institutional investors. The trajectory indicates that B30 cities are not peripheral; they are the epicenter of future capital formation.

Core Drivers Behind the Non-Metro Investment Boom 🚀

Digital Infrastructure: The Catalyst of Accessibility 💻📱

India’s digital revolution has lowered entry barriers for investors across non-metro regions. Widespread availability of smartphones and high-speed internet allows even residents of remote towns to open Demat accounts, attend webinars, and track market movements entirely from their devices. Unified Payments Interface (UPI) adoption has simplified digital transactions, eliminating friction associated with traditional banking. The rural market now records higher frequency of digital payments, directly correlating with increased stock market participation.

FinTech platforms like Zerodha, Upstox, and Groww have capitalized on this accessibility, offering zero-commission trades and user-friendly interfaces. By explicitly targeting unserved and underserved markets, these platforms have transformed digital novices into disciplined investors. The confluence of technological readiness and behavioral adoption has fueled a retail investment explosion in previously untapped geographies. 🌐

Financial Awareness & Regional Localization 📚🗣️

Information accessibility is a potent driver of market engagement. Traditional saving methods are giving way to digital-first education via YouTube, finance apps, and webinars. Regional language enablement has emerged as a crucial factor in deepening penetration. Platforms offering vernacular tutorials report higher sign-ups, emphasizing that true market expansion requires linguistic and cultural localization. This trend ensures that B30 markets are no longer secondary but primary arenas for sustainable capital growth.

Profiling the New Retail Investor: Ambition Meets Risk 🎯⚠️

The B30 investor cohort is disciplined yet highly speculative. Despite lower incomes (70% earn below ₹5 lakh annually), they actively participate in Systematic Investment Plans (SIPs), with monthly contributions reaching ₹26,632 crore in April 2025 across 8.38 crore active accounts. This indicates strong adoption of long-term wealth compounding strategies.

However, risk appetite remains extreme. B30 investors allocate 86% of their assets to equity schemes, and F&O trading is significantly higher than in T30 regions. The ratio of F&O traders to mutual fund investors stands at 28.6 per 100, compared to 17.8 in metros. This reveals a paradox: disciplined SIP habits coexist with high-leverage speculation, exposing lower-income investors to substantial financial risk. 📉

This duality underscores the critical need for targeted financial education, focusing on distinguishing between prudent investment and hazardous speculation. Without intervention, mass panic selling during downturns could destabilize the very markets these new investors are helping to expand.

Regulatory Challenges and Investor Safeguards ⚖️🛡️

Despite surging account numbers, financial literacy remains a concern. Only 27% of Indian adults meet minimum financial literacy standards, creating vulnerability in non-metro markets. Digital divides, smartphone limitations, and infrastructure gaps exacerbate these risks.

The National Strategy for Financial Education (NSFE 2020-2025) aims to address these gaps through coordinated initiatives by SEBI, RBI, IRDAI, and PFRDA. Programs focus on financial awareness, rural inclusion, and trust-building via simplified processes like Re-KYC camps at the Panchayat level.

SEBI has proactively tackled digital misconduct, particularly unregistered Finfluencers who disseminate unauthorized investment advice. Since 2024, SEBI mandates registration for all investment advisors, removing over 15,000 unregulated content sources. Continuous regulatory monitoring, particularly in regional languages, is critical to protect B30 investors from misinformation-driven speculation. 📲

Strategic Roadmap for Sustainable Non-Metro Growth 🛣️

Localization & Product Tailoring 🌐

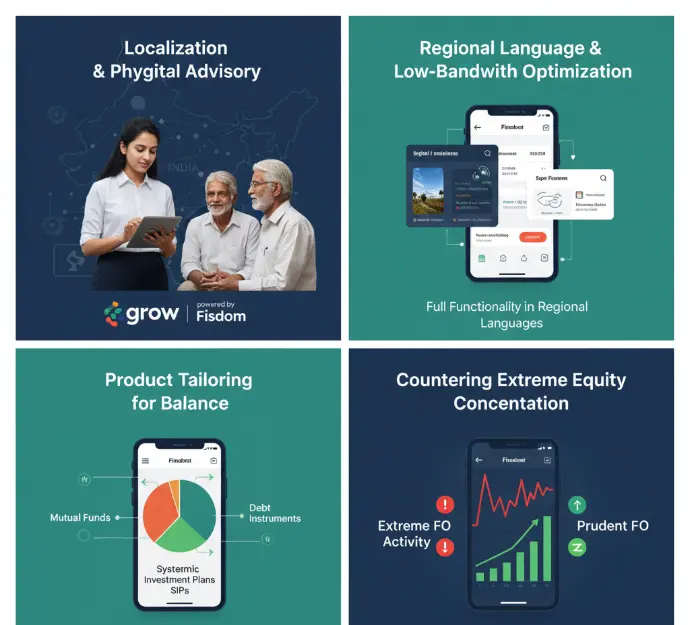

Financial firms must embed localization in strategy. This includes full application functionality, tutorials, and customer support in regional languages, optimized for low-bandwidth conditions. Phygital advisory combining digital platforms with trusted local advisors addresses the high-trust culture in small towns. Mergers and acquisitions in FinTech, such as Groww’s acquisition of Fisdom, exemplify blending scalability with local trust.Balanced products are crucial. Firms must promote mutual funds, debt instruments, and systematic investment channels to counter extreme equity concentration and high F&O activity. Diversifying portfolios ensures resilience against volatility while maintaining growth momentum.

Financial Education & Trust Building 📖💡

Targeted campaigns must focus on differentiating investment from speculation, using regional channels to combat misinformation. Integrating initiatives with NSFE ensures standardization and credibility. Women’s financial literacy is particularly impactful, empowering households and creating community champions for sustainable financial inclusion.

Policy & Regulatory Recommendations ⚖️

Given the high speculative exposure in B30 cities, SEBI should enforce stricter F&O eligibility, including mandatory risk assessment and potential minimum income criteria. Continuous RegTech monitoring is necessary for real-time enforcement of advisory compliance. Streamlining KYC and grievance redressal mechanisms ensures that first-time investors can navigate formal finance without confusion or delay.

Conclusion

Paving the Path to a Financially Empowered Bharat 🇮🇳💹

The rise of Tier-2 and Tier-3 investors is not a transient trend; it represents a structural shift toward a financially empowered Bharat. B30 participation is expected to channel nearly $9.5 trillion into financial assets over the next decade. The opportunity is immense, but the risk paradox must be managed with education, regulation, and local trust-based interventions.

By integrating digital convenience with localized advisory networks, promoting disciplined investment, and ensuring continuous regulatory oversight, India can transition from a volume-driven investment boom to sustainable, value-driven growth. The democratization of capital has begun, and the next decade will define how India leverages its youthful, ambitious, and increasingly financially literate population to build a resilient financial ecosystem. 🌟💸