Structure of Blog: Expert Analysis of Hybrid Insurance Plans Under New IRDAI Rules (2024-2025)

Navigating the New Regulatory Paradigm 🌐💼

The landscape of hybrid insurance in India has entered a phase of profound transformation, catalyzed by the Insurance Regulatory and Development Authority of India’s (IRDAI) ambitious roadmap to achieve "Insurance for All by 2047." 🏦💡 The 2024–2025 regulatory overhaul has not merely adjusted existing norms but has fundamentally reshaped the dynamics of both Unit Linked Insurance Plans (ULIPs) and traditional guaranteed savings policies. Policyholders now encounter a market that is intensely structured around transparency, liquidity, and strategic protection, compelling insurers to rethink the design, pricing, and distribution of their hybrid offerings. In this evolving ecosystem, the distinction between long-term investment instruments and pure insurance products has become increasingly sophisticated, demanding nuanced understanding from both policyholders and industry practitioners alike. The crux of this regulatory transformation rests on the twin pillars of enhanced Special Surrender Value (SSV) norms for traditional plans and comprehensive reforms for ULIPs, designed to align investor expectations with regulatory prudence while ensuring equitable outcomes.

The Hybrid Insurance Ecosystem ULIPs and Traditional Plans 💼📊

In the contemporary Indian life insurance market, hybrid insurance plans straddle the dual objectives of protection and savings. ULIPs epitomize the synthesis of investment and insurance, offering policyholders the opportunity to allocate premiums across equity, debt, and hybrid funds while retaining life cover. Here, the investment risk is inherently borne by the policyholder, and the product's value is directly tethered to market performance. 🏦📈 The IRDAI (Linked Insurance Products) Regulations of 2019 laid the foundational governance framework, but the 2024 Master Circulars have introduced structural refinements, reinforcing the long-term protection mandate while mitigating mis-selling risks.

Traditional, non-linked savings plans, on the other hand, promise guaranteed benefits, creating a stark contrast in risk allocation. The life insurer assumes all investment risk, guaranteeing maturity benefits through instruments such as endowment policies and money-back plans. This fundamental difference delineates the strategic choice for policyholders: risk-adjusted returns versus certainty of payout. The recent reforms have augmented policyholder protection by introducing enhanced SSV provisions, ensuring meaningful liquidity even in premature exits. The juxtaposition of ULIPs and traditional plans illustrates a careful balancing act between market participation and capital security a paradigm that reflects the IRDAI’s broader objective of sustainable, inclusive financial protection.

Master Circulars 2024: Consolidation and Strategic Oversight 🏛️🖋️

The IRDAI’s issuance of multiple Master Circulars in 2024 signifies an ambitious attempt to streamline compliance, harmonize product standards, and fortify policyholder rights. Circulars spanning registration, capital structure, amalgamation, operations, life and health insurance products, and policyholder protection collectively impose rigorous oversight on insurers. 🏦🛡️ These directives not only redefine product parameters but also introduce operational imperatives, such as enhanced surrender value calculations, revised distributor commission structures, and a disciplined approach to marketing.

Compliance deadlines, particularly the September 30, 2024 mandate for product modifications, create a compressed timeline that challenges insurers’ actuarial, operational, and distribution frameworks. Companies must swiftly reconcile traditional product structures with SSV mandates, recalibrate commissions under Expenses of Management (EoM) caps, and ensure alignment with segmented tax regulations. The IRDAI’s strategic intention is clear: to cultivate a market environment that prioritizes policyholder security without compromising the innovative potential of insurers.

Enhanced Special Surrender Value Policyholder Protection Reimagined 💰🔒

The introduction of enhanced SSV norms is arguably the most consequential regulatory shift for traditional hybrid products. Effective October 1, 2024, these provisions ensure that policyholders can access meaningful payouts after just one full year of premium payments, a departure from the previous requirement of two consecutive years. This recalibration of early-exit liabilities significantly enhances policyholder autonomy while compelling insurers to rethink their capital allocation strategies. The calculation methodology, grounded in the Expected Present Value (EPV) of paid-up benefits, introduces actuarial sophistication that transcends simple fixed-percentage models.

Insurers are permitted to employ a marginally elevated discount rate (up to 50 basis points above the 10-year G-Sec yield), offering minor mitigation against heightened liquidity risk. The strategic implication is profound: the financial burden of early exits now shifts decisively from policyholder to insurer, prompting rapid product repricing, adjusted guaranteed returns, and potential restructuring of commission models. For policyholders, the enhanced SSV ensures security without unduly penalizing short-term liquidity needs, exemplifying a policyholder-centric regulatory philosophy.

ULIPs Under the Microscope: Lock-ins, Charges, and Transparency 📈🔍

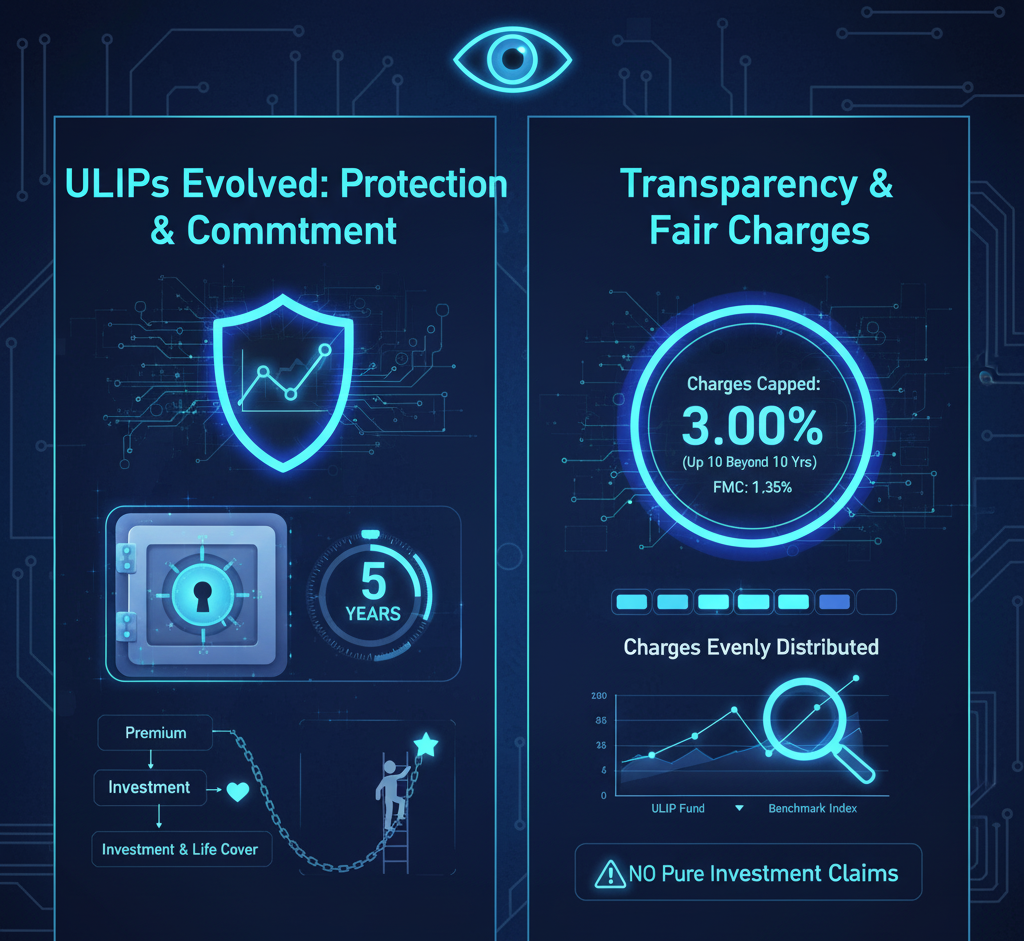

Unit Linked Insurance Plans, long criticized for opacity and high initial charges, now face a regulatory environment that emphasizes long-term commitment, cost rationalization, and transparent disclosure. The IRDAI mandates a minimum five-year lock-in, an increase from the prior three years, while adjusting the minimum sum assured multiple to enforce substantive life coverage. These structural changes reinforce ULIPs as protection-cum-investment instruments rather than mere wealth accumulation vehicles.

Charge structures have been capped meticulously: total annualized charges cannot exceed 3.00% for policies up to ten years and 2.25% beyond ten years, with Fund Management Charges restricted to 1.35% per annum. Furthermore, charges must be evenly distributed across the five-year lock-in period, preventing disproportionate early deductions that could erode policyholder returns. Advertising and market conduct regulations explicitly prohibit promotion of ULIPs as pure investment products, ensuring clarity and reducing mis-selling risks. Mandatory standardized performance disclosure, including comparison with benchmark indices, underscores the IRDAI’s commitment to transparency.

Taxation, GST, and Expenses of Management Operational Realities 🏦💸

The Finance Act, 2021, and subsequent regulations have imposed structured limits on ULIP premium thresholds, emphasizing tax compliance and segmentation. Annual premiums exceeding ₹2.5 lakh now trigger taxation of maturity proceeds, thereby delineating retail investors from high-net-worth individuals using ULIPs as tax optimization instruments. This regulatory segmentation informs both product design and strategic investor decisions.

GST exemptions effective September 22, 2025, promise greater affordability for policyholders. While the removal of the 18% premium tax reduces costs, insurers must absorb the loss of Input Tax Credit, necessitating internal cost optimization to pass benefits effectively to policyholders. Expenses of Management (EoM) regulations impose strict operational discipline, curbing front-loaded commissions and incentivizing trail-based remuneration aligned with policy longevity. Collectively, these measures enforce financial prudence while fostering policyholder-centric incentives and operational efficiency.

Strategic Outlook: ULIPs vs Mutual Funds and Traditional Plans ⚖️📊

In the contemporary investment ecosystem, ULIPs and mutual funds compete on distinct axes: liquidity, risk, cost, and tax treatment. ULIPs, with mandatory five-year lock-ins and capped charges, appeal to goal-oriented investors seeking structured protection alongside disciplined wealth accumulation. Mutual funds offer higher liquidity and, historically, superior long-term, tax-adjusted returns but lack embedded life coverage. The regulatory recalibration narrows this gap, enhancing ULIP competitiveness without compromising policyholder protection.

Traditional guaranteed plans, while facing downward pressure on Internal Rate of Return (IRR) due to enhanced SSV, remain relevant for risk-averse investors prioritizing capital safety. Insurers are likely to adopt conservative fund management strategies, longer lock-ins, and more sophisticated payout structures to reconcile liquidity obligations with sustainable guarantees. For policyholders, this environment demands informed decision-making, balancing immediate liquidity needs against long-term protection and tax efficiency.

Conclusions and Policyholder Recommendations 🏁🔑

The regulatory interventions of 2024–2025 have redefined hybrid insurance dynamics, placing policyholder protection at the forefront. Enhanced SSV norms shift early-exit risk from the insured to the insurer, ULIPs are reinforced as disciplined, transparent, and tax-efficient instruments, and operational reforms incentivize long-term policy retention. Policyholders are advised to review SSV calculations carefully, ensure compliance with premium thresholds for tax benefits, and align product selection with long-term financial goals rather than short-term liquidity needs.

The strategic challenge for insurers lies in balancing actuarial recalibration, operational efficiency, and market competitiveness while navigating a highly regulated environment. For readers, understanding these nuances is essential to leverage hybrid insurance as a potent tool for wealth creation, risk mitigation, and financial security in an increasingly regulated and disciplined market.