The 2025 Millennial Roadmap

Sequencing for Success 🗺️

Hierarchy matters: pay down debt > snare the employer match > maximize HSA > fill IRA/Roth > only then invest in a taxable brokerage account.

Stabilize: Build value-driven budgets, lock in insurance, establish emergency funds, slay high-interest debt first.

Accumulate: Capture that sweet employer match, max out your HSA, then IRAs. Expand emergency stashes to six months’ survival.

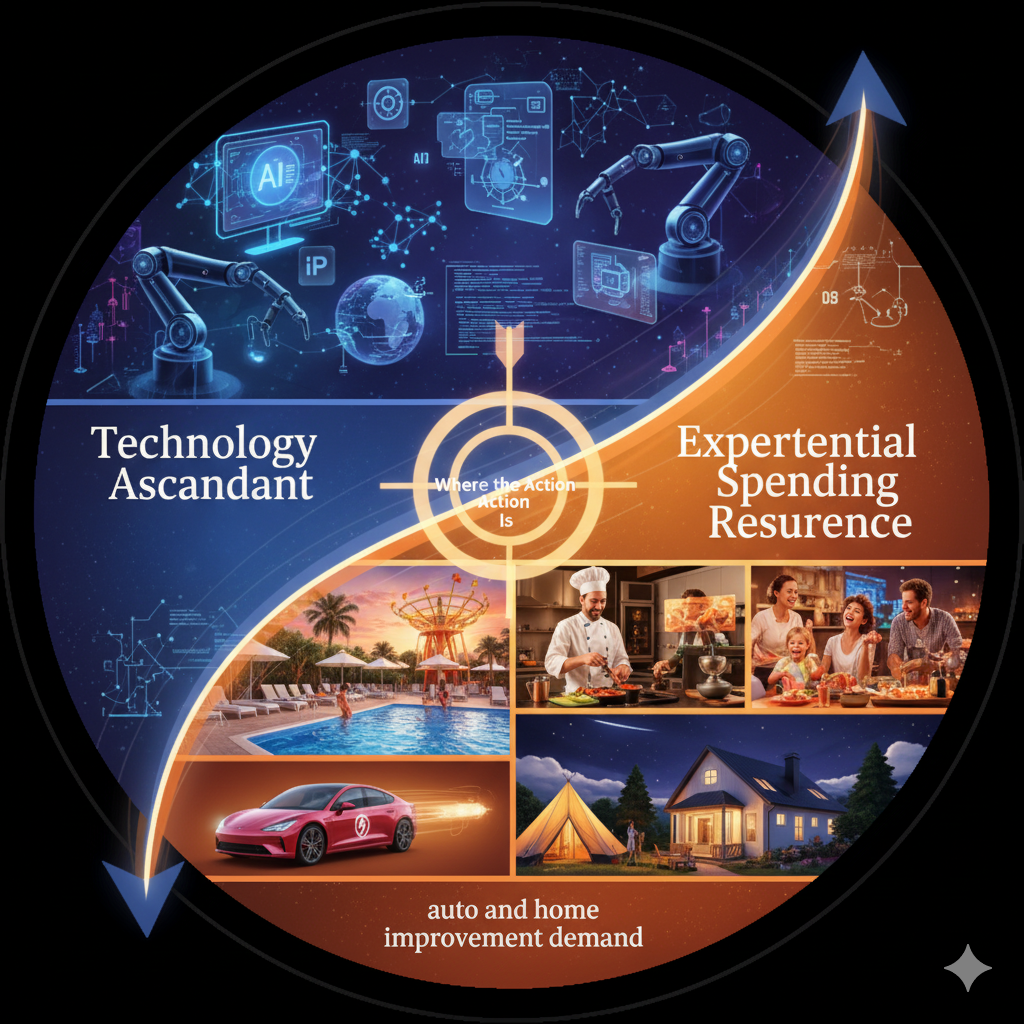

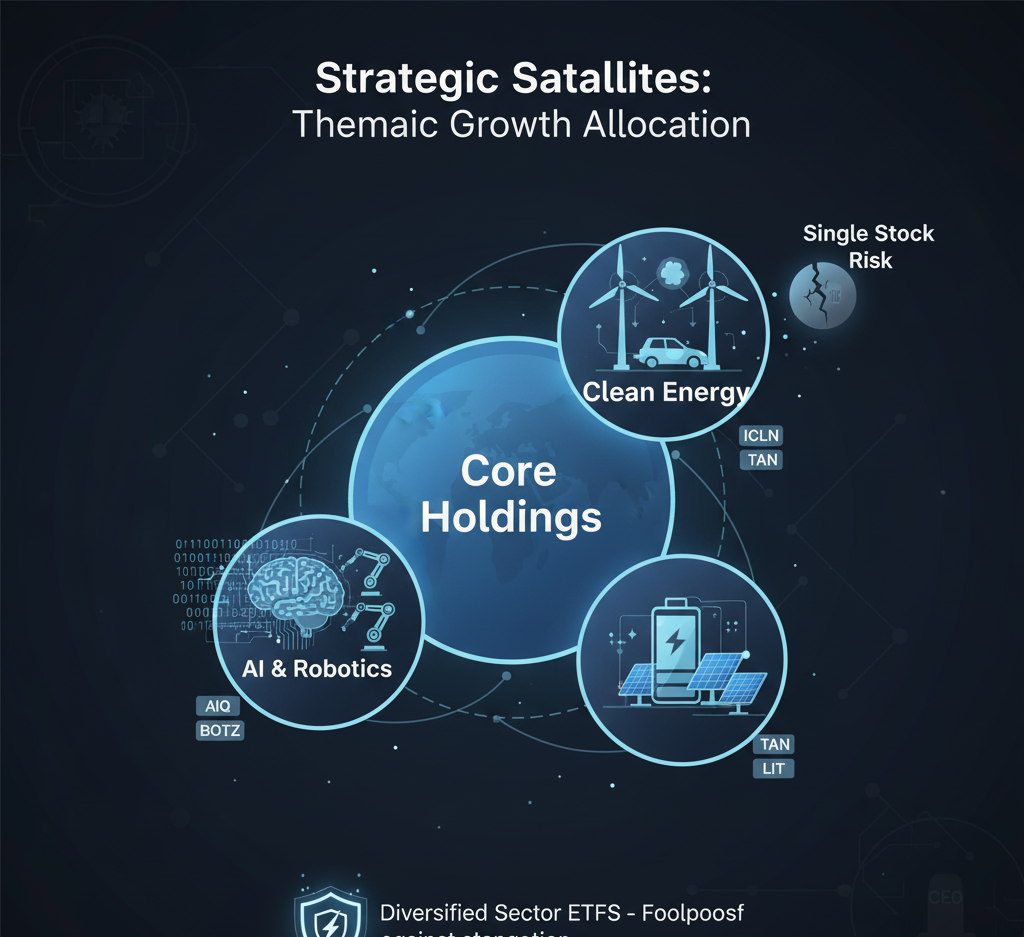

Accelerate: Deploy excess capital in broad ETFs, layer on conviction-based satellites (AI, clean energy, fractional art/real estate), optimize for post-tax value.

Finance isn’t a sprint; it’s a series of practiced, forceful lunges punctuated by periodic recalibration, always with an eye on “future-proofing” against storms.