The Dual Engine of India’s Digital Economy

How RBI’s Digital Rupee and UPI are Shaping the Future of Payments 🚀💳💡

India’s digital economy is evolving at an extraordinary pace, reshaping how money moves, how people transact, and how financial inclusion is achieved. Over the past decade, the country has built a solid Digital Public Infrastructure (DPI), rooted in Aadhaar for identity verification and the Jan Dhan Yojana for financial inclusion. These foundational pillars have enabled India to leapfrog traditional financial limitations, allowing millions to access banking services through just a smartphone. 🌐✨

Central to this revolution is the Unified Payments Interface (UPI), launched in 2016 by the Reserve Bank of India (RBI) and operated by the National Payments Corporation of India (NPCI). UPI has transformed India into a global leader in high-frequency, low-cost digital transactions, connecting banks, businesses, and individuals in a seamless ecosystem. Alongside this, the Digital Rupee (e₹) a sovereign digital currency is now emerging as a complementary force. While UPI handles everyday retail transactions, the Digital Rupee addresses strategic needs like financial stability, offline payments in remote regions, and programmable government transfers. Together, these systems form the dual engine of India’s digital economy, driving efficiency, inclusion, and innovation. 🚀💸

UPI: The Engine of Everyday Digital Payments 💳📱

UPI is more than just a payment platform; it is a technology-agnostic bridge connecting banks, merchants, and users in real time. By leveraging an API-based architecture, it enables seamless peer-to-peer (P2P) and peer-to-merchant (P2M) transactions. Unlike proprietary payment networks, UPI is an open ecosystem, allowing multiple banks and fintech players to innovate on top of it. This openness has created competition, driven service improvements, and fostered public trust a model recognized globally as an exemplary Digital Public Infrastructure. 🌍✨

The numbers speak volumes. By early 2025, UPI was handling over 12.1 billion transactions in a single month, with quarterly transaction values reaching ₹17.6 trillion ($211 billion). It now accounts for 80% of retail payments in India, demonstrating how digital payments have penetrated urban and rural India alike. Impressively, over 55% of rural Indians are now using UPI, transacting in more than 26 regional languages, which illustrates how technology can bridge longstanding access gaps. 🌾💡

UPI’s success has not only redefined convenience but also set a high bar for any new payment system. The zero-cost model for end users ensures frictionless adoption, creating expectations that any new innovation, including the Digital Rupee, must meet or exceed in order to gain traction. 🔥

The Digital Rupee: A Sovereign Innovation 💰🏛️

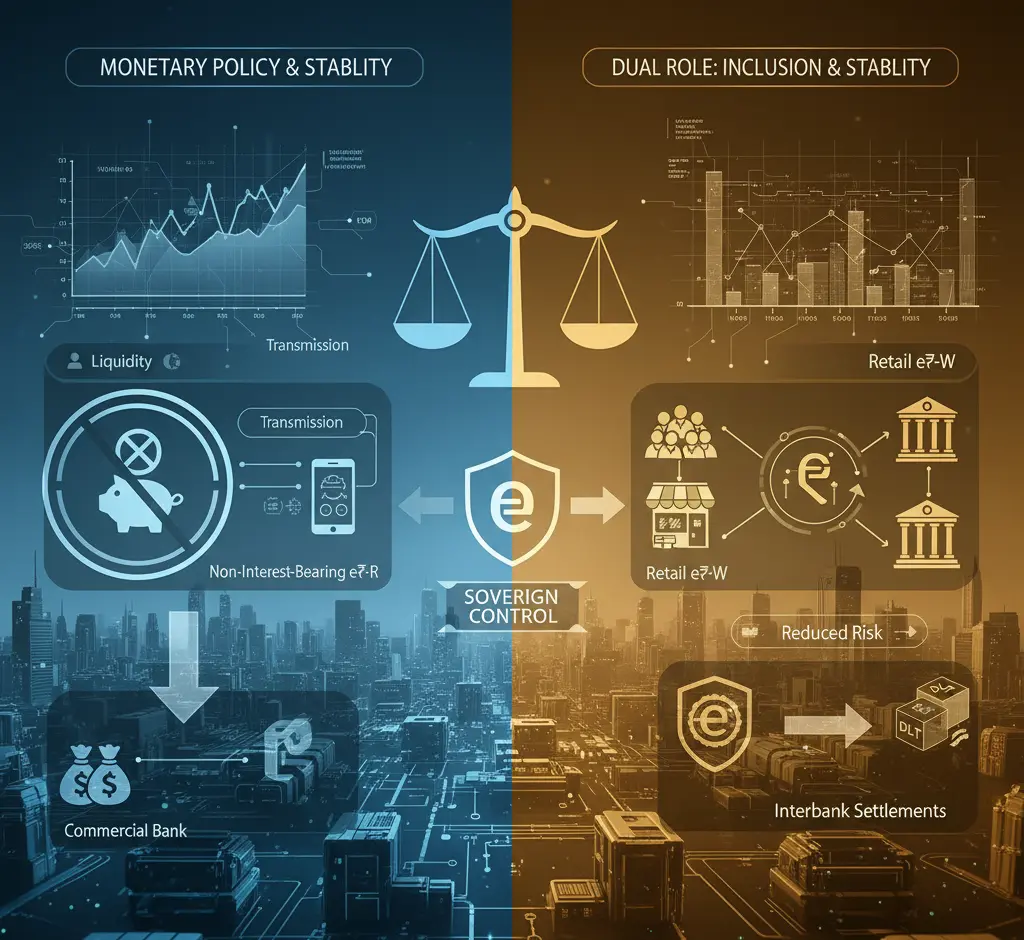

While UPI dominates everyday transactions, the Digital Rupee (e₹) represents the RBI’s vision of a central bank-issued digital currency. Unlike UPI, which transfers commercial bank deposits, the e₹ is sovereign legal tender, a digital form of cash directly issued and guaranteed by the RBI. It leverages Distributed Ledger Technology (DLT) to ensure transparency, security, and efficiency, with two primary forms:

Retail CBDC (e₹-R): Designed for everyday use, mirroring physical cash.

Wholesale CBDC (e₹-W): Focused on high-value interbank transactions, settlements, and financial market efficiency. 💹

The rollout has been cautious by design. Retail e₹ adoption is deliberately low to prevent bank disintermediation, with non-interest-bearing issuance encouraging substitution mainly from cash rather than deposits. As of May 2024, e₹ circulation was just 3.23 billion rupees, tiny compared to the 35.4 trillion rupees of physical currency in circulation. This conservative approach prioritizes financial stability over immediate adoption. ⚖️

The Digital Rupee also promises offline functionality, bridging the digital divide in rural or low-connectivity areas. Using NFC or telecom-based communication, the e₹ ensures transactions even where internet access is unreliable truly cash-like in convenience, but digital in form. 🌐📲

Bridging Gaps

How UPI and e₹ Complement Each Other 🤝💡

The genius of India’s payment strategy lies in functional specialization. UPI handles high-volume, everyday transactions across urban and semi-urban areas. The e₹, on the other hand, is tailored for strategic policy goals:

Financial inclusion in remote regions

Offline retail payments

Programmable government transfers (DBT)

Cross-border remittances

Reduced operational costs in currency management 💹

By design, the Digital Rupee complements UPI, rather than competing. Interoperability is key: merchants can accept payments via either UPI QR codes or e₹ QR codes, reducing friction and encouraging adoption without requiring new infrastructure. This dual approach ensures resilience, redundancy, and sovereign control over the digital monetary base. 🏛️🔗

Privacy, Anonymity, and Strategic Edge 🔒🕵️♂️

Privacy is a critical differentiator. UPI transactions are tied to KYC-verified bank accounts, offering traceability but limiting anonymity. The e₹, in contrast, is designed to offer cash-like privacy, particularly for low-value transfers. This privacy-by-design approach balances anonymity with regulatory oversight, ensuring security while promoting adoption in demographics sensitive to surveillance.

Moreover, the e₹’s offline capability addresses a fundamental UPI limitation: connectivity dependence. In remote villages, where smartphones may have intermittent internet access, the e₹ ensures financial inclusion, empowering millions who were previously excluded from digital finance. 🌾📱

Macro and Monetary Implications of the Digital Rupee 📊🏦

The introduction of a CBDC impacts monetary policy, liquidity, and financial stability. To mitigate risks such as bank disintermediation, the RBI has designed the e₹-R to be non-interest-bearing, discouraging users from moving deposits from commercial banks into e₹. This preserves bank liquidity, ensures monetary policy transmission, and maintains overall system stability.

For wholesale operations, e₹-W uses DLT for interbank settlements, reducing counterparty risk and settlement time, improving efficiency in high-value financial markets. This combination of retail and wholesale functionalities highlights the dual role of the Digital Rupee: inclusion and strategic market stability. 💹⚖️

Adoption Challenges and Strategic Refinements 🚧🧩

Despite its promise, the e₹ faces adoption hurdles. UPI’s ubiquity, convenience, and zero cost create high user expectations, making the Digital Rupee adoption slower. Educating users about differences, benefits, and programmability is crucial. Initiatives include in-person training, awareness campaigns, and incentivized integration with government programs like DBT.

Security, privacy, and regulatory compliance remain central. Offering cash-like anonymity while ensuring traceability for anti-money laundering (AML) purposes requires sophisticated protocols. Public trust in the central bank’s technological capabilities is paramount to adoption.

The Road Ahead Coexistence and Global Ambitions 🌏💡

Enhance your business operations with our comprehensive suite of professional services, tailored to meet your corporate needs.

- India’s long-term vision is coexistence, not competition. UPI continues to dominate high-frequency retail payments, while the Digital Rupee strengthens financial inclusion, programmable money, and cross-border remittances.

2024–2026: Focus on interoperability, dual QR code adoption, and offline retail use.

2027–2030: Expand programmable features for government transfers, mature e₹-W for wholesale settlements.

2030 onwards: Position e₹ as a tool for international trade, enhancing the Rupee’s global competitiveness. 🌐💰

This strategy ensures resilience. UPI’s dependence on banks and third-party apps could pose risks in case of failure or market concentration. The Digital Rupee, operating independently via DLT and offline-enabled wallets, provides redundancy and sovereign control, reinforcing India’s position as a global fintech innovator. 🚀