🌍 Comprehensive Roadmap for Global ETF Investment by Resident Indian Investors 💼✨

In the evolving landscape of personal finance, one truth has become increasingly undeniable diversification is no longer an optional exercise, it is a structural necessity. For the resident Indian investor, who has long remained confined within the borders of domestic equities, debt, and gold, the world of Global Exchange-Traded Funds (ETFs) now stands as an open gateway to truly international wealth creation. Over the past two decades, markets have proven that exposure beyond India is not merely about chasing higher returns. Instead, it is about creating a resilient portfolio that can withstand shocks, minimize risks, and most importantly, protect long-term purchasing power against the relentless depreciation of the Indian Rupee 💸.

🔑 Why Global Diversification is a Strategic Imperative 🌐

When we think about wealth, most investors instinctively focus on return percentages. Yet, any seasoned financial advisor will emphasize that wealth is not only about what you earn, but about what you keep. And what you “keep” is determined by risk, volatility, and the unseen erosion of currency value. For Indian investors, the biggest silent enemy of wealth has historically been the steady decline of the Indian Rupee against major global currencies like the US Dollar. 📉

Consider this: over decades, the INR has persistently lost ground against the USD, transforming every international expense whether foreign education, overseas travel, or global consumption into a heavier burden on the Indian wallet. Holding assets denominated in USD, through instruments like global ETFs, acts as a structural hedge. In simpler words, your wealth gets “insured” in hard currency terms, ensuring that the long-term erosion of purchasing power does not silently eat away at your prosperity.

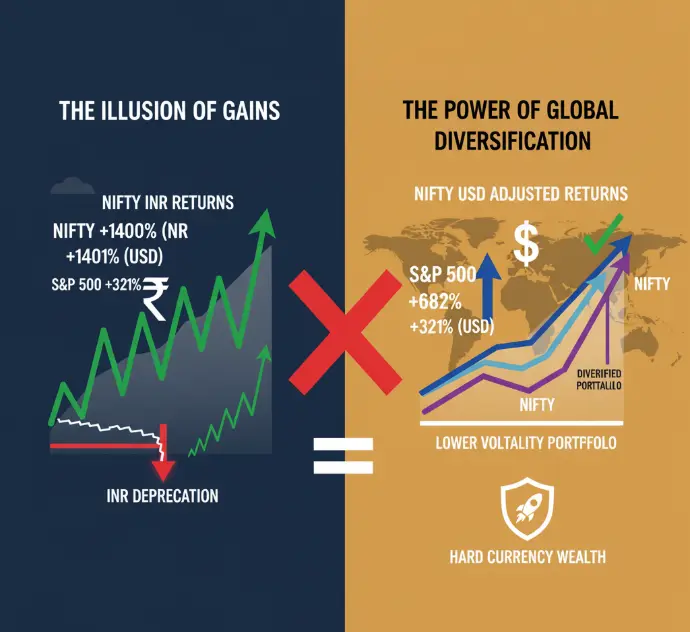

Now, here’s the catch. Many investors make the mistake of directly comparing Nifty’s performance with the S&P 500’s performance without adjusting for the currency effect. On paper, Nifty might look like a shining star with returns that sometimes seem to dwarf those of global indices. But once adjusted for USD-INR depreciation, the margin narrows drastically. What initially looked like overwhelming outperformance turns into a sobering reminder: a good portion of those inflated INR returns was simply the mirror image of a weakening currency.

📊 The Myth of Nominal Returns vs. The Reality of Currency-Adjusted Wealth

Take the classic long-term comparison: the Nifty surged by nearly 1400% in nominal terms over 25 years, while the S&P 500 clocked around 321% in the same period. At first glance, it feels like the Indian market has crushed its global counterpart. But here lies the deception when adjusted for USD terms, the Nifty’s return drops to nearly 682%. Still impressive, but nowhere close to the grand illusion of 1400%.

What this tells us is simple but profound: part of the “extraordinary” domestic return story is nothing more than the depreciation of the rupee against the dollar. This means that if your goal is to preserve wealth in international purchasing terms, ignoring global exposure is equivalent to closing your eyes to a slow leak in your financial pipeline.

Furthermore, diversification is not just about currency. It is about volatility reduction. Modern portfolio theory is crystal clear: when you combine assets with low or negative correlation, the overall risk of your portfolio reduces, even if the returns remain constant. The Indian and US markets, for example, often move in different cycles. Between 2005 and 2009, Nifty rallied hard while the S&P remained dull. Between 2010 and 2019, the roles reversed. A low correlation sometimes even negative between these markets ensures that when one stumbles, the other cushions the fall. The result? A smoother, less stressful investment journey 🚀.

💡 What Exactly Are Global ETFs and Why They Matter

Global ETFs, or Exchange-Traded Funds, are not some exotic financial invention. Think of them as simple baskets of international securities, available on your screen just like Indian mutual funds or shares. Instead of betting your fortune on one foreign stock (say Apple or Tesla), you can own a basket that tracks the S&P 500, the Nasdaq 100, or even specific sectors like energy, healthcare, or technology.

The beauty lies in simplicity and structure. They allow you to instantly diversify across companies, industries, and geographies, reducing the idiosyncratic risks that come with betting on individual international stocks. For a retail investor in India, this is a much more efficient, less volatile way to play the global story. 📈

🛤️ The Two Pathways for Indian Investors

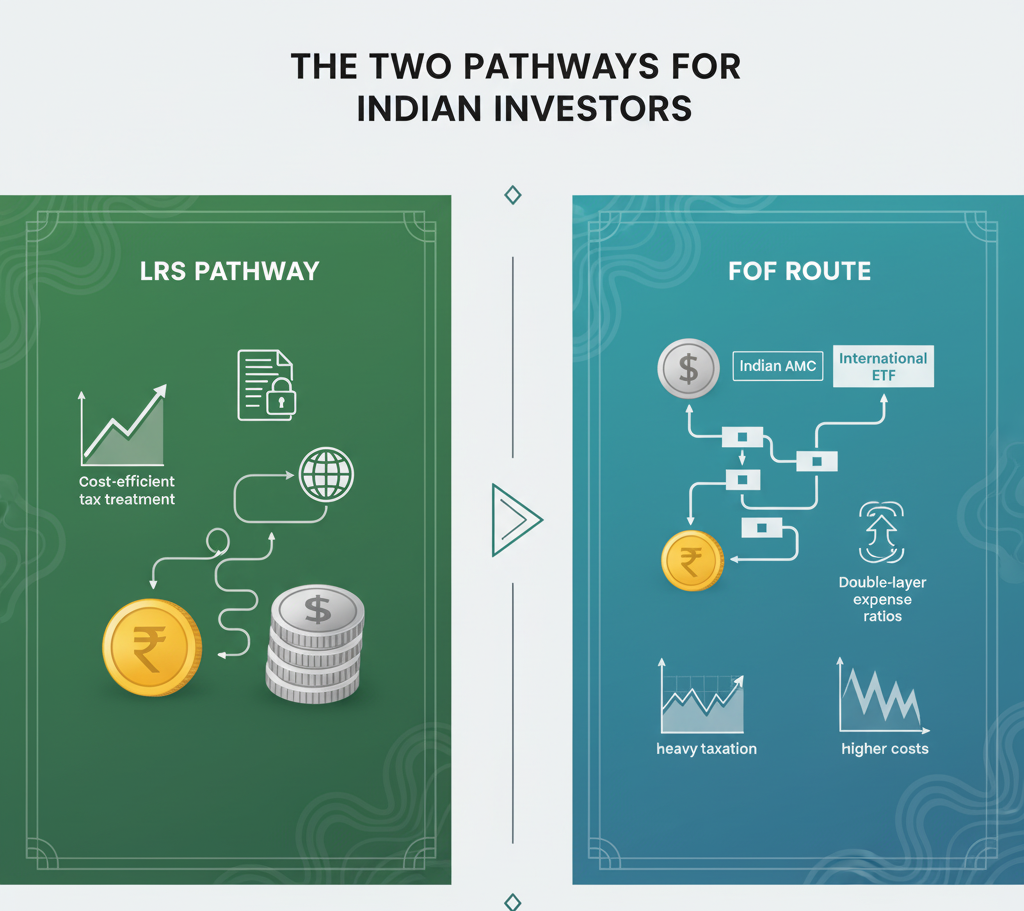

Resident Indians have two clear routes for entering global ETF investments:

The Direct Liberalised Remittance Scheme (LRS) Pathway 🌍

The Indirect Fund of Funds (FoF) Route 🇮🇳

Each pathway has its pros, cons, and nuances.

The LRS Route allows investors to directly remit up to $250,000 abroad annually, buying foreign-listed ETFs on global exchanges like NYSE or NASDAQ. It is compliance-heavy but cost-efficient, giving you direct control over your holdings and favorable long-term tax treatment.

The FoF Route, on the other hand, is about convenience. You stay entirely in INR, invest via Indian AMCs, and your money flows into international ETFs indirectly. It bypasses complex currency conversions and compliance but carries higher costs, double-layer expense ratios, and post 2023 heavy taxation that eats into returns.

For the sophisticated investor, the choice is rarely about convenience. It is about optimization. And here, the LRS route often emerges as the fiscally superior option for high-net-worth individuals who can manage compliance.