🚀 Robo-Advisors in 2025

A Complete Guide with Expert Insights & Real-World Experience

Have you ever sat down, opened your trading app, and felt a sudden rush of anxiety? 📉 Your screen flashes red, the market dips, and your mind instantly starts calculating losses. This is the exact problem robo-advisors were designed to solve eliminating emotional chaos and replacing it with structured, algorithm-driven calmness.

In my 12+ years of financial consulting, I’ve seen countless investors make rash decisions. Some sold their stocks in panic during COVID-19, only to regret it when the market rebounded 📊. Robo-advisors prevent this very mistake by automating portfolio allocation, rebalancing, and even tax optimization all at a fraction of the cost of human advisors.

👉 In this blog, I’ll walk you through what robo-advisors are, how they actually function, where they shine (and fail), plus real-world comparisons of popular platforms in 2025.

🌐 What Exactly Is a Robo-Advisor?

Think of a robo-advisor as your financial GPS system 🛰️. Just like you enter a destination in Google Maps and it calculates the best route, you answer a few questions about your goals, risk tolerance, and timeline, and the robo-advisor designs your investment path.

It doesn’t panic.

It doesn’t get greedy.

It doesn’t need sleep. 😴

Behind the scenes, these platforms rely on Modern Portfolio Theory (MPT), risk-adjusted optimization, and passive index fund allocation. You don’t need to track the market daily; the system quietly rebalances and optimizes your investments.

💸 Cost Advantage

Why Fees Matter More Than You Think

One of the first lessons I share with new investors is this: Fees are silent killers of wealth.

Imagine you invest $100,000 for 20 years.

A traditional advisor charging 1% annually will take away more than $44,000 in fees.

A robo-advisor, charging 0.25%, will only cost you about $11,000.

That’s a $33,000 difference without lifting a finger! 🏦

This is where robo-advisors truly shine. They’re not free, but their 0.20%–0.35% average management fee is far lower than traditional human advisors.

📊 Behavioral Finance

The Hidden Value of Robo-Advisors

Now here’s where most people underestimate robo-advisors. Their true strength isn’t just low fees. It’s psychological discipline.

I’ve had clients call me in panic during downturns “Should I sell everything? The market is crashing!” 😨

A robo-advisor, however, doesn’t even blink. It stays disciplined, keeps your allocation intact, and nudges you with goal-based alerts instead of fear.

This makes them perfect for:

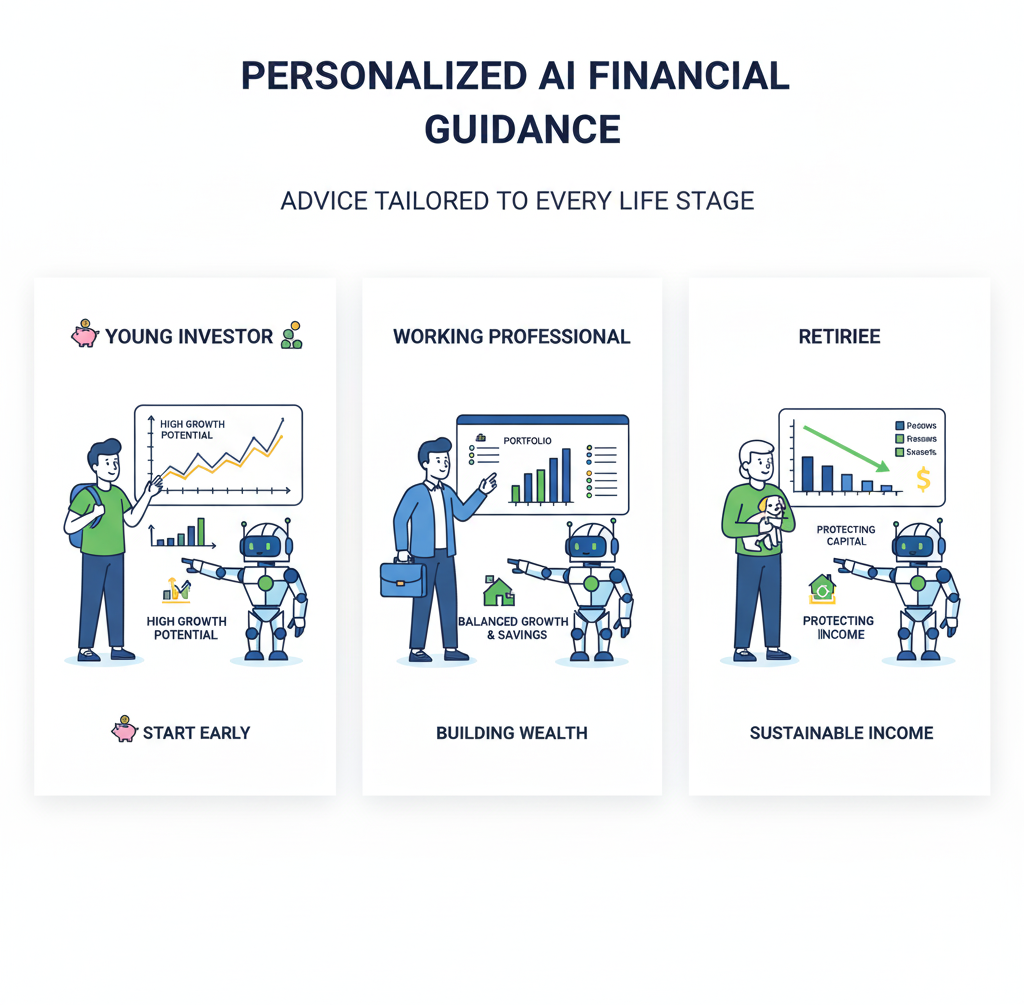

First-time investors 🐣

Busy professionals 👩💻

Retirees who want peace of mind 🌅

Robo-Advisors

Here’s the truth: No system is perfect.

If you’re a high-net-worth investor with complex needs (estate planning, tax law strategies, cross-border investments), you still need a human advisor.

But for 90% of retail investors, robo-advisors provide 80% of the value at 20% of the cost.

Traditional Advisors

Comparison Snapshot (2025):

Betterment: Best for beginners (Low fees + goal tracking).

Wealthfront: Advanced tax-loss harvesting, great for tech-savvy users.

Fidelity Go: Trusted brand, low-cost option with strong research tools.

📜 Regulations

Can You Trust Them?

Trust is everything in money management. In the U.S., robo-advisors are registered with the SEC (Securities and Exchange Commission) and regulated under the Investment Advisers Act of 1940.

In India 🇮🇳, SEBI (Securities and Exchange Board of India) has introduced strict guidelines ensuring robo-advisors operate transparently, disclose risks, and protect investors.

So yes ✅ they are safe, but always stick with SEBI-registered (India) or SEC-registered (US) platforms.

🛠️ Practical Roadmap

Should You Start With a Robo-Advisor?

Here’s my honest, experience-backed advice

Start with a robo-advisor. It’ll teach you discipline, diversification, and patience.

Use it for your core portfolio (retirement, emergency fund) while exploring direct stock picking on the side.

A hybrid approach works best — robo-advisor for passive core allocation + human advisor for complex tax/legal strategy.

🌟 Conclusion

My Experienced Take

I’ll end this with the most important lesson I’ve learned after advising 500+ clients:

👉 “Wealth isn’t built by timing the market, it’s built by time in the market.”

Robo-advisors make this process smoother, cheaper, and emotionally stable. They aren’t perfect, but in 2025, they’ve become a powerful ally for everyday investors.

If you’re just starting out, don’t overthink. Test one, invest small, and let data + discipline work in your favor.

Because in the end, the smartest investors are not the ones who chase trends but the ones who stay consistent. 🚀📈