🏦 Stablecoins and Banking 2.0: The Future of Finance

🌍 Introduction: The Dawn of a New Financial Era

In 2025, the financial landscape is undergoing a monumental transformation. Traditional banking systems, once the cornerstone of global finance, are being challenged by innovative digital assets stablecoins. These cryptocurrencies, pegged to stable assets like the U.S. dollar, are redefining how we think about money, transactions, and financial inclusion.

Stablecoins offer the promise of instantaneous, borderless transactions, enhanced transparency, and reduced costs, making them a compelling alternative to traditional financial systems. As we delve into this topic, we'll explore how stablecoins are shaping the future of banking and what this means for individuals and institutions alike.

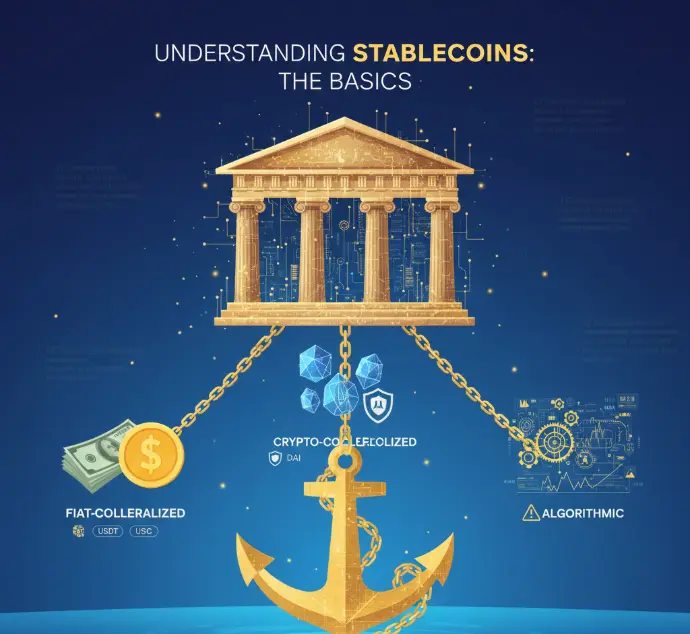

🏛️ Understanding Stablecoins: The Basics

At their core, stablecoins are digital currencies designed to maintain a stable value by being pegged to a reserve asset, typically a fiat currency like the U.S. dollar. This stability makes them less volatile than traditional cryptocurrencies like Bitcoin or Ethereum, which can experience significant price fluctuations.

There are several types of stablecoins:

Fiat-Collateralized Stablecoins: These are backed 1:1 by fiat currencies held in reserve. Examples include Tether (USDT) and USD Coin (USDC).

Crypto-Collateralized Stablecoins: These are backed by other cryptocurrencies, often over-collateralized to account for volatility. An example is DAI, which is backed by Ethereum and other assets.

Algorithmic Stablecoins: These rely on algorithms to control the supply of the stablecoin, adjusting it to maintain price stability. However, they have faced challenges in maintaining their peg during market volatility.

📈 The Rise of Stablecoins: Market Growth and Adoption

The adoption of stablecoins has been nothing short of explosive. In 2024, the total transaction volume of stablecoins surpassed $27.6 trillion, exceeding the combined transaction volumes of Visa and Mastercard. This growth is driven by several factors:

Increased Demand for Efficient Cross-Border Payments: Stablecoins offer a faster and cheaper alternative to traditional remittance services.

Integration into Decentralized Finance (DeFi): Stablecoins are integral to DeFi platforms, enabling lending, borrowing, and trading without intermediaries.

Institutional Adoption: Major financial institutions are beginning to explore and integrate stablecoins into their operations.

🏦 Stablecoins vs. Traditional Banking: A Comparative Analysis

| Feature | Traditional Banking | Stablecoins |

| Transaction Speed | 1–3 days | Instantaneous |

| Cross-Border Payments | Expensive & Slow | Low-Cost & Fast |

| Transparency | Limited | High |

| Accessibility | Banked Populations | Anyone with Internet |

| Regulatory Oversight | High | Varies by Jurisdiction |

This comparison highlights the advantages of stablecoins in terms of speed, cost, and accessibility. However, it's important to note that stablecoins also present unique challenges, particularly concerning regulation and security.

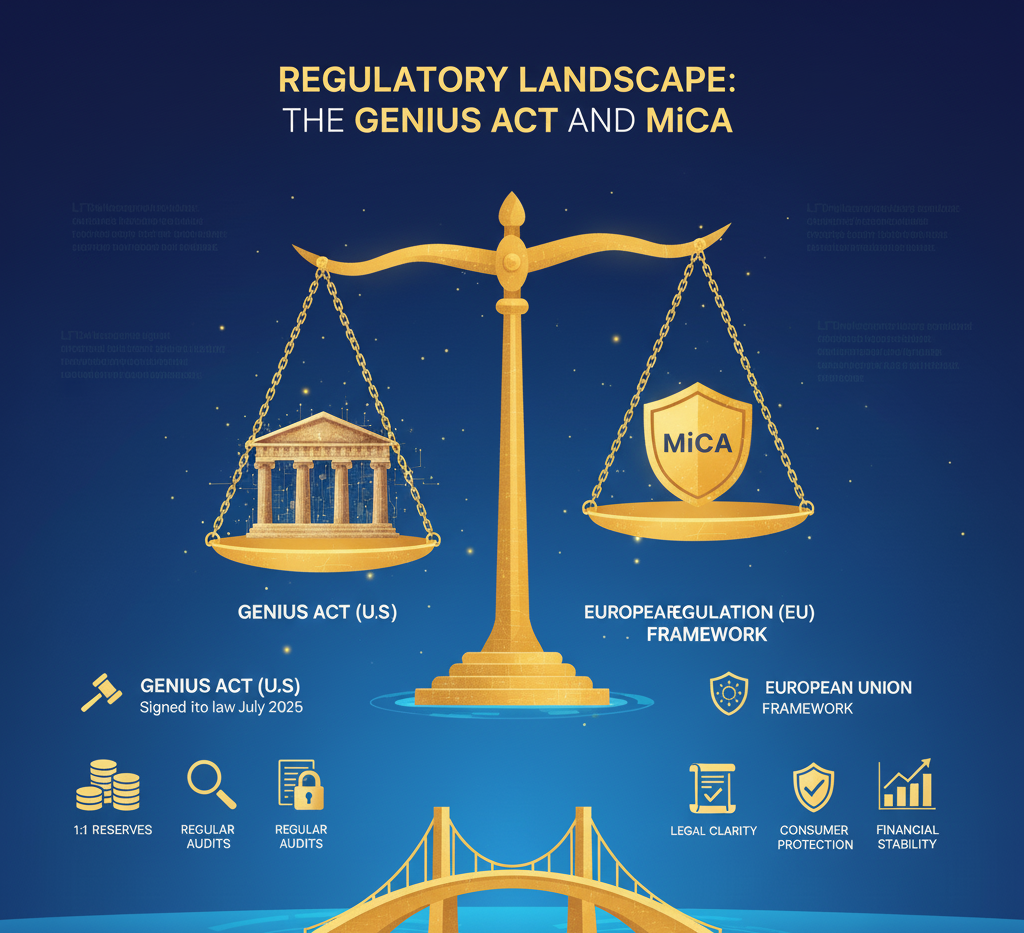

⚖️ Regulatory Landscape: The GENIUS Act and MiCA

As stablecoins gain traction, governments and regulatory bodies are stepping in to establish frameworks that ensure their safe and effective use.

GENIUS Act (U.S.): Signed into law in July 2025, the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) provides a comprehensive regulatory framework for stablecoins. It mandates that stablecoin issuers maintain 1:1 reserves, undergo regular audits, and comply with anti-money laundering (AML) and know your customer (KYC) regulations. This legislation aims to foster innovation while protecting consumers and maintaining financial stability.

MiCA Regulation (EU): The Markets in Crypto-Assets Regulation (MiCA) is the European Union's regulatory framework for crypto-assets, including stablecoins. It provides legal clarity and ensures consumer protection, market integrity, and financial stability within the EU.

🏦 Institutional Adoption: Banks and Stablecoins

Major financial institutions are beginning to recognize the potential of stablecoins. For instance, JPMorgan has launched JPM Coin, a digital currency designed to facilitate instantaneous payments between institutional clients. Similarly, Visa and Mastercard are exploring the integration of stablecoins into their payment networks.

This institutional adoption signals a shift towards a more digital and decentralized financial system, where stablecoins play a central role.

🌐 Global Implications: Financial Inclusion and Economic Impact

Stablecoins have the potential to revolutionize financial inclusion. In regions with limited access to traditional banking services, stablecoins can provide a means for individuals to store value, make payments, and access financial services.

Moreover, stablecoins can enhance economic efficiency by reducing transaction costs, speeding up settlement times, and increasing transparency in financial transactions.

📝 Conclusion

Embracing the Future of Finance

Stablecoins represent a significant evolution in the financial landscape. By offering a stable, efficient, and inclusive alternative to traditional banking systems, they have the potential to democratize access to financial services and drive economic growth.

As we move forward, it is essential for stakeholders including regulators, financial institutions, and technology providers to collaborate in creating a secure and sustainable ecosystem for stablecoins.